Technical Analysis vs. Fundamental Analysis in Forex

Two primary approaches dominate the landscape of forex trading analysis: technical analysis and fundamental analysis. In this article, we will explore the distinctions between these two methodologies, examining their strengths, weaknesses, and how a balanced use of both can provide traders with a comprehensive toolset for navigating the complexities of the foreign exchange market.

- Technical Analysis:

- Define and explain the principles of technical analysis in forex trading, focusing on chart patterns, indicators, and trends. Discuss how technical analysis relies on historical price data to forecast future price movements.

- Define and explain the principles of technical analysis in forex trading, focusing on chart patterns, indicators, and trends. Discuss how technical analysis relies on historical price data to forecast future price movements.

- Strengths of Technical Analysis:

- Explore the strengths of technical analysis, such as its applicability to short-term trading, the ability to identify entry and exit points, and the visual representation of market sentiment through charts.

- Explore the strengths of technical analysis, such as its applicability to short-term trading, the ability to identify entry and exit points, and the visual representation of market sentiment through charts.

- Limitations of Technical Analysis:

- Discuss the limitations of technical analysis, including its reliance on historical data and the potential for subjective interpretation. Highlight situations where technical analysis may be less effective, such as during unexpected market events.

- Discuss the limitations of technical analysis, including its reliance on historical data and the potential for subjective interpretation. Highlight situations where technical analysis may be less effective, such as during unexpected market events.

- Fundamental Analysis:

- Define fundamental analysis and its focus on economic, political, and social factors that influence currency prices. Discuss how events like interest rate decisions, economic indicators, and geopolitical events can impact the forex market.

- Define fundamental analysis and its focus on economic, political, and social factors that influence currency prices. Discuss how events like interest rate decisions, economic indicators, and geopolitical events can impact the forex market.

- Strengths of Fundamental Analysis:

- Explore the strengths of fundamental analysis, including its ability to provide a broader market perspective, identify long-term trends, and offer insights into the underlying health of economies.

- Explore the strengths of fundamental analysis, including its ability to provide a broader market perspective, identify long-term trends, and offer insights into the underlying health of economies.

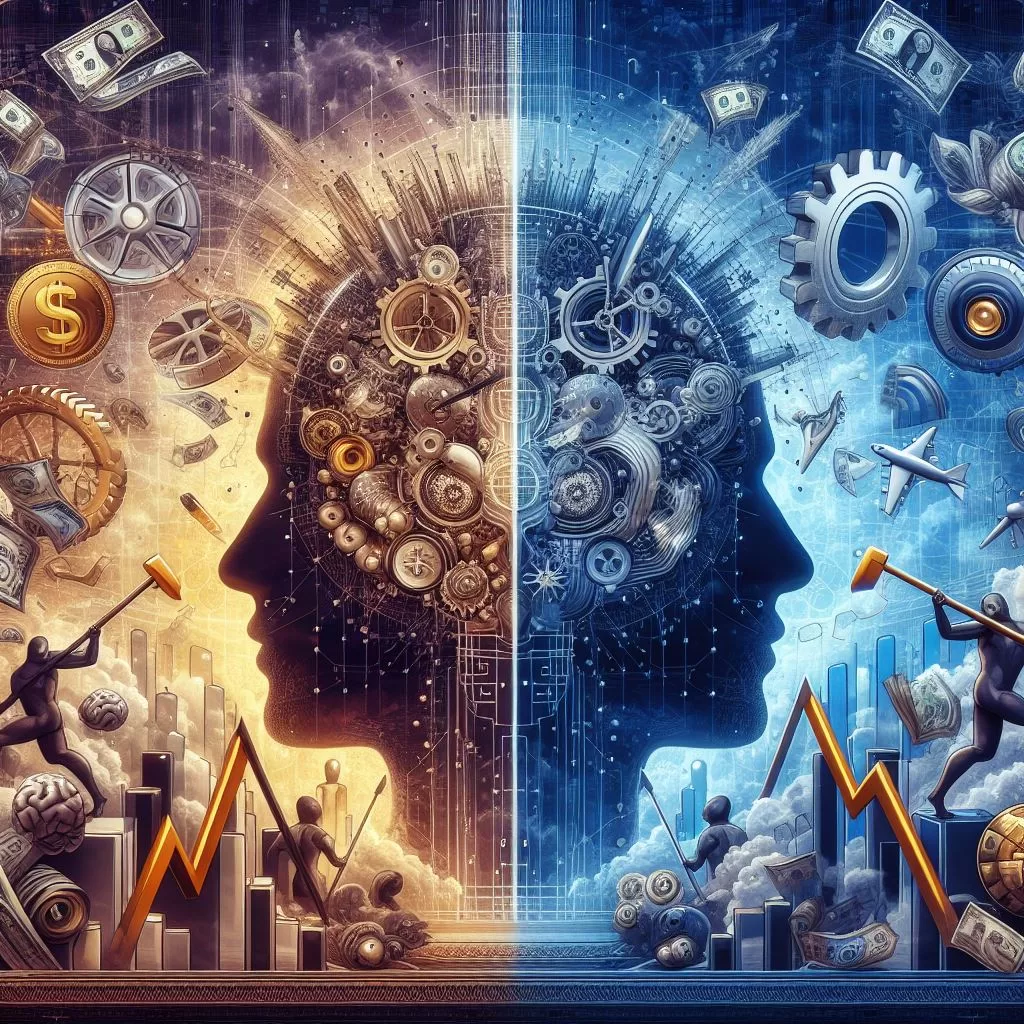

- Combining Technical and Fundamental Analysis:

- Advocate for a balanced approach by combining elements of both technical and fundamental analysis. Discuss how traders can use technical analysis for entry and exit points while considering fundamental factors to understand the broader market context.

In the complex world of forex trading, the choice between technical and fundamental analysis is not binary; successful traders often integrate both approaches. By understanding the strengths and limitations of each method and employing a balanced analysis, traders can enhance their decision-making processes and develop a more comprehensive strategy for navigating the intricacies of the forex market.